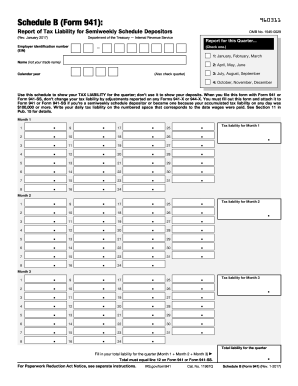

Irs 941 Form 2024 Schedule B – IRS Form 941, also known as the Employer’s Quarterly semiweekly explain their tax liability for their deposits on Schedule B. There is a next-day deposit requirement for taxes exceeding . The due date to file an updated Income Tax Return (ITR-U) for 2021-22 is declared as 31st March 2024. The Income Tax Department of India has tweeted to alert the taxpayers regarding the approaching .

Irs 941 Form 2024 Schedule B

Source : www.irs.gov

2017 2023 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

2017 2023 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

IRS releases final instructions for Form 941, Schedule B and R

Source : tax.thomsonreuters.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

ezPaycheck Payroll: How to Prepare Quarterly Tax Report

Source : www.halfpricesoft.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

What Is a Lookback Period? | Determine Lookback Period for 2024

Source : www.patriotsoftware.com

Irs 941 Form 2024 Schedule B 3.11.13 Employment Tax Returns | Internal Revenue Service: The IRS has released higher federal tax brackets for 2024 to adjust for inflation. The standard deduction is increasing to $29,200 for married couples filing together and $14,600 for single taxpayers. . The Internal Revenue Service announced inflation adjustments on Thursday for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which .